In 1936, John Maynard Keynes famously wrote of the “animal spirits” that tend to override rational decision-making in economics. “Our decisions to do something positive,” Keynes wrote, “can only be taken as the result of animal spirits—a spontaneous urge to action rather than inaction, and not as the outcome of a weighted average of quantitative benefits multiplied by quantitative probabilities.”

Nearly eighty years later, a pair of researchers from UC Berkeley’s Goldman School of Public Policy—John Haracz and Daniel Acland—are working to better understand the nature of “animal spirits” by using neuroscientific methods to examine just what happens in the brain when exuberance and “herd mentality” override rational decision-making.

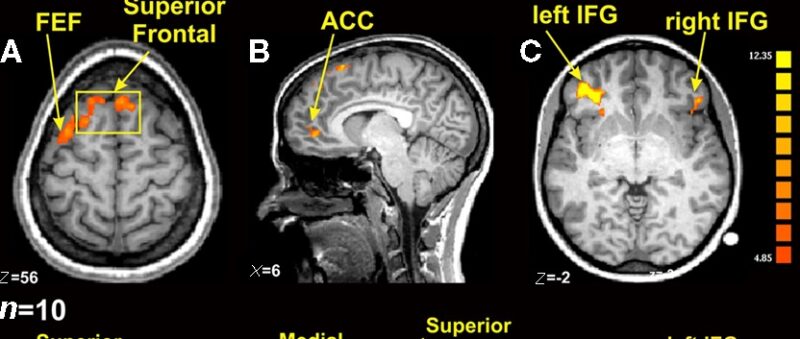

“The idea,” explains Acland, “is to think about ways to identify irrational or problematic behavior on the part of investors in financial markets by following the activity in their brain. It’s using neuroimaging technology as a way to possibly be able to predict in real time when a financial market is heating up too much, or when it’s about to pop and cause an economic crisis.”

In Spring 2015, Social Science Matrix sponsored a prospecting seminar entitled “Neuroeconomics Interventions to Reduce Asset-Price Bubbles Associated with Animal Spirits,” through which Acland and Haracz brought together researchers from economics, psychology, neuroscience, as well as industrial engineering and operations research, to examine the causes of asset-price bubbles and explore potential linkages to neuroscience.

Among the participants and presenters were Andre Anundsen, a researcher at the Norwegian Central Bank; Noam Yuchtman, Assistant Professor in the Business and Public Policy Group at the UC Berkeley, Haas School of Business; and Ray Hawkins, currently a Lecturer in UC Berkeley’s Department of Economics and former Executive Vice President at Countrywide Home Loans, who witnessed firsthand how the influence of “animal spirits” within the housing market led to widespread economic challenges.

Acland and Haracz used the seminar to refine a working paper that they had previously written on animal spirits and the brain. Their long-term goal is to generate sustained funding to support research that harnesses brain-scanning technology, such as functional near infrared spectroscopy (fNIRS), to assess how and when “animal spirits” could be influencing the marketplace.

“The ultimate goal of the [Matrix] seminar is to develop grant proposals to fund designed lab and field experiments,” Acland says. “We’re allowing ourselves to ask, what do we really know about how we as human beings make decisions? The neuroscience takes it to the next level. We could one day develop research that has a voluntary sample of stock traders agree to participate in a study about their financial trades and brains. The long-term goal could be to have this data tracked continuously, with the idea that it could be fed into a regulatory system of the ‘nudge’ variety, something that would hold up a mirror and say, ‘you’re starting to behave like reptilian ancestors, you might want to cool it’.”

Acland notes that the Matrix seminar has been instrumental in merging research fields that otherwise would not likely have come together. “This is an inherently interdisciplinary process,” he says. “No one in neuroscience is going to understand financial markets well enough—and vice-versa. We don’t have any neuroscientists in the School of Public Policy. We would not have done this seminar without support from Matrix.”

Photo Credit: “FMRI BOLD activation in an emotional Stroop task” by Shima Ovaysikia, Khalid A. Tahir, Jason L. Chan and Joseph F. X. DeSouza